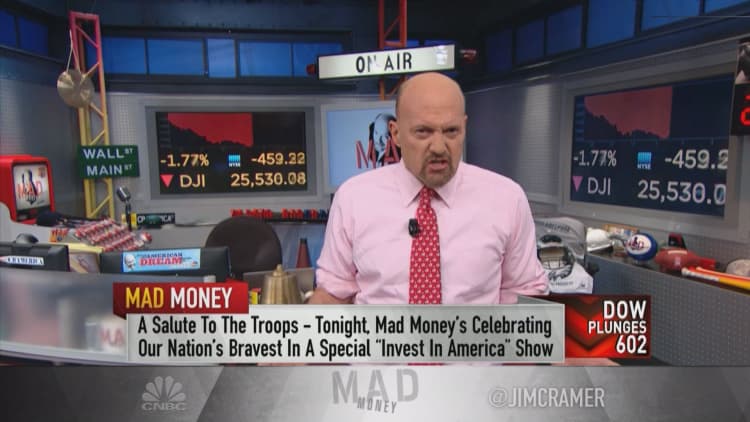

Stocks will only recover from Monday's dramatic sell-off if seven key things happen to brighten the outlook for the broader market, CNBC's Jim Cramer said as the major averages pulled back.

"The thinking behind today's action is surprisingly simple: money managers are buying the winners and selling the losers," he said on "Mad Money." "Unfortunately, there are a heck of a lot more losers than winners, and I want to put that into context because such behavior, frankly, is highly unusual this close to the end of the year."

Here are the things Cramer says will allow stocks to reverse course:

1. Apple

A recovery in the stock of Apple, which led much of Monday's declines after a supplier report implied weakening iPhone orders, would be the first key to a broader reversal, Cramer said.

"It's a tall order. We keep getting new negatives that frustrate buyers," he said. "After today, there's no denying that Apple has some sort of problem selling some of its phones. Is it China? Is it the developing world? Is it a slowdown here in America? We don't know. Maybe it's nothing. Then again, maybe it's something. The question is, what's the solution?"

Cramer figured that, eventually, Apple's pricing structure and positive standing with customers would once again start attracting buyers to the stock. But "judging by the ferocity of the decline, ... we aren't there yet," he warned.

2. FANG

Second, the FANG stocks — Cramer's acronym for Facebook, Amazon, Netflix and Google, now Alphabet — also have to stabilize, the "Mad Money" host said.

To do that, Facebook has to move past its string of data-privacy issues; Amazon's stock has to find its footing following the company's softer-than-anticipated fourth-quarter forecast; people need to find a more cohesive way to value Netflix's stock; and Alphabet needs to buck investors' negativity, Cramer explained.

Of all four FANG members, "Alphabet is the biggest conundrum," he said. "Their stock is pretty inexpensive. They have more than [$]100 billion in cash. They own search. They own online video. They own the self-driving car market, at least for now. I think it's an outright buy. But no one cares. All this will start mattering at some lower price, though."

3. Fed

Third, the market would benefit if Federal Reserve Chairman Jerome Powell acknowledged that he was "winning the war against inflation," Cramer argued. Ideally, that would happen at Federal Open Market Committee meeting in December, at which the central bank is widely expected to raise interest rates again, he said.

Reiterating that he supports one more rate hike, Cramer cited the numerous factors that tell him the economy is slowing: the prolonged decline in oil prices, sliding prices for materials, lower home sales figures and prices, and high mortgage rates.

"Don't forget, Powell thinks it is his job to slow the economy in order to prevent inflation. To be fair, that's part of his job. ... But the way the Fed tames inflation is by slamming the brakes on the economy so that wages stop rising. You know what? I think that's ill-advised," Cramer said. "Powell does not need to say that rate hikes are off the table. He just needs to say he sees concrete evidence that the rate hikes, so far, are working to tame inflation."

4. China

Fourth, any sign that China may cooperate with the Trump administration's trade demands would give stocks a boost, Cramer said, adding that the G-20 summit at the end of the month could be the deciding factor. President Donald Trump and Chinese President Xi Jinping will reportedly meet at the Buenos Aires, Argentina gathering.

"The Chinese economy is slowing faster than most people realize, and when the tariffs automatically increase next year, it will hurt them a lot more than it hurts us," Cramer said.

"Many American companies are frantically moving their orders to Cambodia, to Thailand, to Vietnam," he continued. "It's a huge drain on the Chinese economy and it's accelerating. But it's possible the Communist Party would rather wreck their own economy than be seen bowing to America."

5. Dollar

The U.S. dollar is also becoming "a real headwind" for stock prices, Cramer said.

"Stocks trade based on earnings estimates. The strong dollar, which continues to accelerate versus pretty much every other currency, seems unstoppable," he explained. "That's bad for the earnings of most companies. So, despite the lower energy costs, the earnings estimates for next year are still too high."

6. Quality

The "flight to quality" on Wall Street also needs to end for the broader market to go higher, the "Mad Money" host said, pointing to the rallies in consumer packaged goods stocks like Mondelez, Procter & Gamble and Coca-Cola.

"It's a bad sign — same with the drug stocks," he said. "This says money managers are hiding in stocks that do well in a recession."

7. GE

Finally, shares of General Electric, the closely watched industrial giant in the midst of a long-winded turnaround, need to reverse course, Cramer said.

"This morning my colleague David Faber pulled up with Larry Culp — he's the CEO — and they talked about how the company can turn it around," he said. "All I heard was it's going to take a lot of time, a lot of time, and then a lot of time. If that's the case, why own it? Worse, why not sell it?"

Final thoughts

"Some, if not all, of these things [have] to occur ... before this market can find a sustainable bottom," he concluded. "Everything else is just a phony false floor not to be trusted."

WATCH: Cramer on the sell-off and how to recover

Disclosure: Cramer's charitable trust owns shares of Apple, Amazon and Alphabet.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com