When it comes to your personal financial management, it's just possible you don't know what you don't know.

Maybe you are just getting by, and the paychecks seem to cover most of what you need. You use credit cards to pick up the slack. You are living in the here and now.

If all you're doing is earning and spending, you're doing it wrong.

More from Invest in You:

What hiring managers want to see in your social profile

The secret to getting your resume past the robot rejections

These people in their 30s are doing a simple thing to get rich

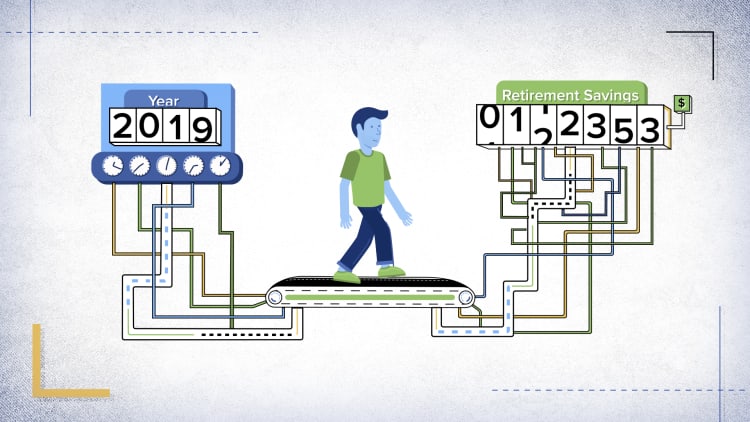

Your focus is adjusted for the present, and your close-up focus spending is a symptom. You need to put the future into view, so you save for retirement and build up an emergency reserve.

We all know the common bad habits, such as not saving (or not saving enough) for retirement, or putting everyday purchases on a credit card if you don't pay off the bill in full.

These spending habits may be more subtle but they can also set you up for future failure.

1. You have no idea where the money goes

Spend better by learning what your habits actually are, says certified financial planner Douglas Boneparth, founder and president of Bone Fide Wealth in New York. Look back at your last 12 months of expenses — your credit card and bank statements will tell you a lot — and categorize your spending.

The point is to assemble a complete picture of what you spend on meals, groceries, entertainment, rent, utilities, transportation and debt repayment (whether student loan or other debt).

Yes, it's tedious and labor-intensive, Boneparth says. This exercise lets you see your behavior around money. It's not just about saying no but understanding how you can use your money to fund your goals.

"Then you can make informed decisions," Boneparth said. "You might even be able to spend more."

2. You lack accountability

Approach money the way you approach fitness, says CFP Chris Kampitsis, a financial planner at the Barnum Financial Group in Elmsford, New York.

Do-it-yourself types find it easier to get to the gym or set up their own fitness routine, while others might prefer working with a trainer or nutritionist.

"If you're really not good at doing this yourself, there are certified financial planners that help people with cashflow," Boneparth said. If necessary, you might want to look for someone who can drill down into your habits to set you on a smoother path.

3. You buy things at the wrong time

At the first hint of a new season, some people rush to buy appropriate clothes and accessories. "Get in the habit of buying items closer to the end of the season instead of the beginning," Kampitsis said.

You can save a lot of money buying a coat in November or December than September, he says. "Same with bathing suits as the summer approaches." Instead of April or May, hold off. By July 4, you'll see deep discounts on all summer clothes.

4. Your bar is too low

If you're patting yourself on the back for minuscule efforts to save, you might want to rethink your strategies.

For some people, satisfaction comes from simply taking full advantage of the employer match, says Kampitsis. But compare that with the person who feels saving for retirement means maxing out to the extent the government allows.

Set your sights higher. Many companies that auto-enroll their staff in the workplace retirement plan start people saving at 3%. Most experts agree that's inadequate.

If you can meet a $400 emergency expense, that's great. Don't rest there. Build up that reserve so you can meet three months' worth of expenses.

5. You don't have any guidelines

Big financial companies benchmark. They check out the competition to see what they're doing, whether it's how much another company charges for services or how their progress stacks up against an organization of a similar size.

People need to do their own benchmarking to see how they're doing. How much should someone your age be making, spending and saving? If you don't compare, you won't know what's typical within reasonable limits.

"At 24, 25, you're just trying to figure out your place in the world," Boneparth said. "But it certainly doesn't mean you shouldn't be saving.

"Whether you know or it not, you do have a goal," he added. "Do you have a 401(k) plan at work?

"Have you heard of investing?" Boneparth said. "It doesn't replace the fact that you should be searching for goals."

Check out What entrepreneurs like Daymond John and Ryan Serhant learned about money from summer jobs via Grow with Acorns+CNBC.

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.