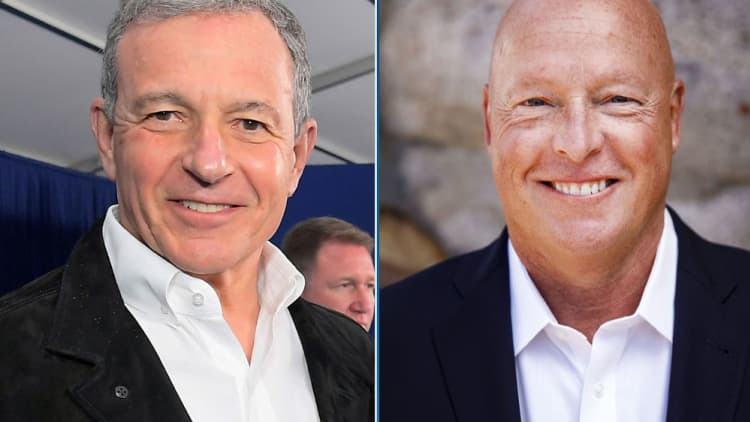

Bob Iger's surprise announcement that he's stepping down as CEO of Disney and handing the reins over to parks chairman Bob Chapek comes during a time of massive change at the company.

For much of its existence, Disney's media business thrived by selling its channels, movies and TV shows through cable networks and other distributors.

But with the launch of Disney+ late last year, along with ESPN+ and its complete takeover of Hulu, Disney is now making a grand pivot from a B2B business to a B2C business. Over time, that means Disney will become less reliant on the money it collects based on the dwindling pool of cable subscribers and more reliant on selling directly to consumers.

Chapek will be in charge of navigating one of the biggest shifts in media at one of the world's largest entertainment conglomerates. Iger is sticking around as executive chairman of Disney, and Chapek will report to him during a transition period that will last through the end of 2021, when Iger retires. During that time, Iger will focus on creative projects — bringing you more Baby Yodas and Disney princesses — while Chapek focuses on the day-to-day operations of the company.

So what's on Chapek's plate as he takes over?

Disney is still in the early stages of its transition, and it'll be several more years before the streaming wars settle down and we get a clearer picture of which players will survive. Chapek is considered one of Disney's operations experts with a 27-year tenure at the company, which makes him an attractive CEO for the next chapter of Disney. It also helps that he was running Disney's parks and products businesses, which already have a direct relationship with customers. Now he'll be able to bring that mojo over to the media side of Disney.

Here's where things stand as Chapek takes over:

Disney+ is off to a strong start. Disney said in its last earnings report it had 26.5 million Disney+ subscribers as of early this month, about 2½ months after its launch. That means the service's growth is well ahead of the pace it needs to be to reach its goal of at least 60 million subscribers by the end of the company's 2024 fiscal year. It's also promising that Disney+ was only available in North America and a few smaller markets. It will launch in Europe on March 24 and continue expanding from there.

Big changes are coming to Hulu. Disney took complete control of Hulu last year and has already hinted at changes it plans to make to the streaming service as it integrates with the broader Disney portfolio. Hulu's CEO Randy Freer stepped down on Jan. 31. Disney said his departure comes as it plans to "more closely integrate" Hulu with the Disney mothership, with its executives reporting to Disney's direct-to-consumer team.

Hulu will also get a boost now that it's fully part of Disney. For example, Hulu will start seeing more content from FX, following Disney's acquisition of Fox, which was completed last year. Iger told CNBC last November, "We're going to create a huge FX presence on Hulu."

Disney said in its last earnings report that Hulu has 30.7 million subscribers.

ESPN+ is a limited offering, with big potential in the future. Disney's stand-alone streaming option for ESPN hasn't seen as much success as Hulu or Disney+. Disney in January said ESPN+ has 7.6 million subscribers. However, ESPN+ is part of Disney's new streaming bundle, which also includes Hulu and Disney+, all for $12.99 per month.

For now, ESPN is still in limbo as Disney navigates the transition from linear TV to streaming. ESPN+ only streams limited sports offerings from leagues like UFC, but lacks major properties like NFL and NBA games. Most of the money for ESPN is in linear TV, but that could change as various rights for major sports leagues are available for auction.

Disney will be competing with every major media company in the streaming wars. Netflix. Amazon Prime Video. AT&T's HBO Max. NBCUniversal's Peacock. A new service for the various ViacomCBS brands. Apple's Apple TV+. All of those services are either available now, or about to launch, meaning Disney has to compete with several well-funded brands all hungry to quickly grow subscribers. Not everyone will succeed, but Disney already has a huge head start thanks to the early success of Disney+, giving it a solid foundation.

It's going to be a challenging ride for Chapek, but as Iger said during an investor call Tuesday, all the pieces are in place for new leadership. The Fox acquisition has closed. The Disney+ launch was a massive success. And there are big plans for Hulu and ESPN. According to Iger, the timing was right for him to hand over control to Chapek.

"I obviously have big shoes to fill," Chapek told CNBC's Julia Boorstin on Tuesday.

Disclosure: Peacock is the streaming service of NBCUniversal, parent company of CNBC. Comcast is the parent company of NBCUniversal.