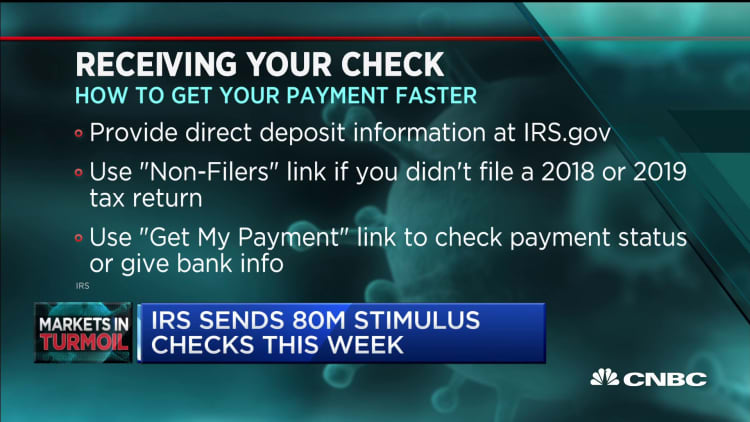

Last week more than 80 million Americans began receiving coronavirus stimulus checks. The payments are part of the $2.2 trillion stimulus bill passed to aid Americans suffering financially as a result of the coronavirus pandemic. The Economic Impact Payments, as the IRS deemed them, are worth up to $1,200 for individuals or $2,400 for married couples, plus $500 for each qualifying child.

If you have already received yours and are itching to spend it, you may want to take pause and think carefully before you do to avoid any foolish money moves, says behavioral economics expert Jeff Kreisler.

"A lot of our financial decisions that are often irrational are about stress and uncertainty, and that is really heightened right now," said Kreisler, co-author of "Dollars and Sense: How We Misthink Money and How to Spend Smarter."

According to a survey released by the National Endowment for Financial Education, the coronavirus is causing 9 in 10 Americans to feel anxious about money.

In an interview with CNBC's "Squawk on the Street" co-anchor David Faber, Kreisler reminds people to think about what their values are. "It's important to try and get a bigger perspective," he says, adding that aligning your spending with your values will help you spend wiser.

More from Invest in You:

These scams are designed to steal your stimulus check

You really should resist the siren call of cashing out your 401(k)

Yes to brunch, no to Coachella. How younger Americans plan to spend after the coronavirus

Kreisler also pointed out that stress and uncertainty can manifest from what he calls mental accounting. We treat money differently depending on how we obtained it, he says. For instance, when we earn money from a job, we prioritize those funds toward important necessities such as rent or groceries. But receiving a lump sum handout such as the stimulus check may not hold the same significance in our minds

"We treat money differently depending upon how we feel about it. Money that we think of as sort of a windfall or a lottery winning we spend on silly stuff, like more lottery tickets."

Kreisler suggests that people try to think of the money from the stimulus as money earned. Think about how that money will be spent and how it will be saved.

There are a couple of ways to rewire your brain to think about the stimulus check.

Instead of treating your stimulus check as one lump sum, think about it as an installment program. Kreisler suggests that a payment system will help you distinguish between the important spending and the fun spending. This is because we often treat large lump sums as prize money. "You can think of it as a steady payment, almost like an increase in salary."

You can also choose to hide your money. This may sound contrived, but hiding money can be as simple as setting up automatic transfers among your checking and savings accounts.

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox.

CHECK OUT: How to use your stimulus check to invest for the future via Grow with Acorns+CNBC.

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.