Glenda West was hoping to retire in comfort with her wife, Juliana.

Yet like many Americans, the 60-year-old has seen her retirement plans thrown out of whack by the coronavirus pandemic.

"We had a clear plan on how much to put away every year," said West, who owns a small construction company with her wife in Seattle.

"When you see your income cut in half you think, 'Oh, what is that going to mean?'"

The couple had been putting aside 10% of every paycheck they received. They have about $1 million in retirement savings, but want to double that in order to be able to retire comfortably.

While they were deemed an "essential business" during the crisis, they haven't been able to start any large projects. Their company's earnings have been slashed in half.

So instead of putting money into their retirement account, they are holding onto it in case of emergency. While the company has some work now, she's concerned about what the future will bring.

"I am worried about being able to retire at all, when I don't know what this new world order is going to bring." she said.

More from Invest in You:

Picking up the financial pieces after a loss: 'We didn't plan death'

How to decide if tapping into your retirement savings is the right move for you

Need money? Find cash in these unexpected places

"It just feels like the world is a lot more uncertain than it used to be."

She's certainly not alone. About 23% of workers who are employed or recently unemployed said their confidence that they will be able to retire comfortably has gone down, according to the Transamerica Center for Retirement Studies.

So what can you do to get back on track?

It depends on your situation, said personal finance expert and New York Times best-selling author Suze Orman.

Focus on emergency savings first

If you aren't earning income right now, you can't contribute to your individual retirement account or 401(k) plan. Instead, focus on surviving right now and, if possible, building up at least an eight-month emergency fund, she said.

If your income has been cut, also concentrate on that emergency savings first.

"If I was really struggling, I would keep all the money in a money market or in a high-yielding savings account, at a credit union or an online bank, whichever gives you the highest interest rate right now," said Orman, author of several books, including "The Ultimate Retirement Guide for 50+," and the host of the Women and Money podcast.

"If I really was cutting it close, I would not be investing in the stock market here," she added. "I would not be doing anything … until I had a job and I felt that job was secure and I had income coming in."

401(k) savings contributions

If you are still working and have a 401(k), Orman advises at least contributing up to the point of your employer's matching contribution.

When you don't, you'll be missing out on essentially free money from your employer.

If you have the choice of putting your money into a Roth 401(k), choose the Roth "all the way," she said.

Roth contributions are made after tax, unlike traditional plans which are made pre-tax. Therefore, you will not pay taxes when you take your disbursements as you will with traditional retirement accounts.

Retirement is going to look very different.Suze Ormanauthor

"If you think that income tax brackets are not going to have to skyrocket to pay for the deficits that we have created in the future, I have a bridge to sell you," Orman said.

While there are no income limits for Roth 401(k) plans, there are for Roth IRAs.

With the Roth IRA, you can contribute up to $6,000 a year, plus an additional $1,000 if you are age 50 or over. However, if you are single, you must have a modified adjusted gross income under $139,000. If you are married and filing jointly, your income must be under $206,000.

Social Security

Orman generally suggests that people don't claim Social Security until they are 70 years old, becasue waiting will add a guaranteed 8% to your monthly payout.

That's just what West is planning to do, especially because these are her high earning years. She was eligible for her full benefits when she was 66.

However, if you are married and both spouses are born before Jan. 1, 1954 Orman suggests not holding off and checking with ssa.gov to find out the best strategy for you.

West should file for Social Security when she is around 68 and let her wife, who is a year and a half younger wait until she is 70, since she is the higher wage earner, she said.

In fact, that's just what Orman and her wife recently did.

"It's very different if you're married," she said. "A lot of people aren't taking advantage of all the benefits they should really be doing."

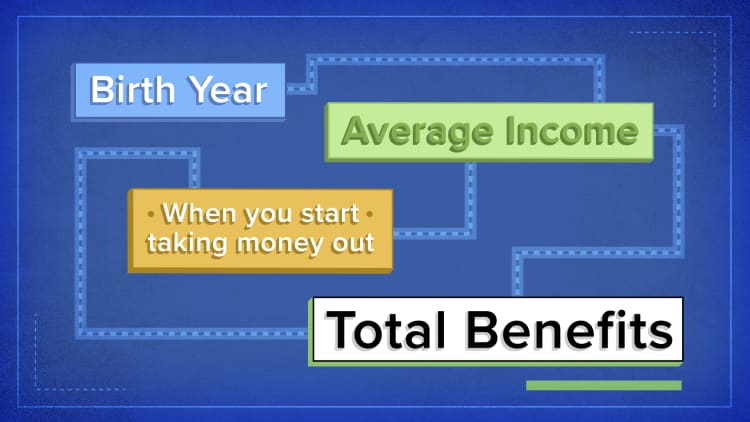

To better understand what makes the most sense for you, use the calculator on the Social Security website.

Income annuities

Orman said she believes "we will come to another harder time financially in the market" and that interest rates will continue to stay low for a long time.

So, if you are looking for guaranteed income, you may want to consider an income annuity, she said.

They are essentially a locked-in payment you receive every month in retirement from an insurance company for a set number of years. You can either pay a lump sum up front before your retirement, or pay in through your 401(k) or IRA.

Experts tend to disagree on whether it is a good investment, with some arguing that they have high commissions and their disclosures aren't very transparent.

Retirement is something that needs more intention than it's ever needed.Suze OrmanAuthor

Orman is strictly talking about income annuities, also known as fixed income, and not fixed indexed, which are based on the performance of a stock market index, or variable ones, which have fluctuating interest rates.

"If you're investing in the stock market, and the stock market isn't going well … you need guaranteed income for you to live on," Orman said. "You have Social Security, and that's it.

"You cannot count on the income from stocks, bonds," she added, pointing out that companies are already starting to reduce or suspend their dividends.

She also cautions that people do their homework and not be "sold a bill of goods."

"People need to be very careful," she said.

Retirement is going to look very different

Looking ahead, Orman thinks that people will be working longer and retiring later.

"Retirement is going to look very different," she said.

What's more, those who may have sold out in the market's downturn in March may feel locked out and "petrified" to go back in now that it has rebounded.

"They have no place to put that money to earn interest for them," she said.

"Retirement is something that needs intention."

Watch the full "Invest in You: Ready. Set. Grow Your Future – A CNBC & Acorns Town Hall Special" here.

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox.

CHECK OUT: How I became a millionaire in my 30s and retired early by learning to invest during the 2008 recession via Grow with Acorns+CNBC.

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.