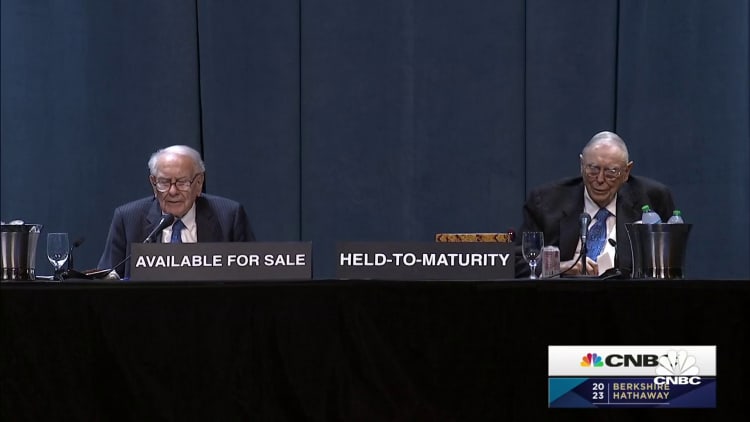

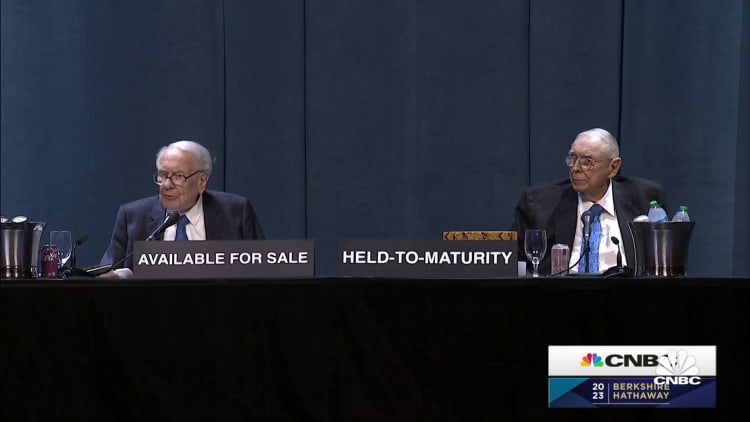

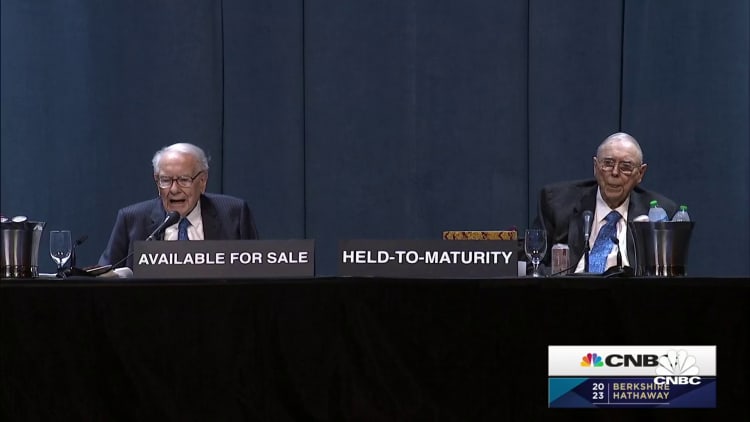

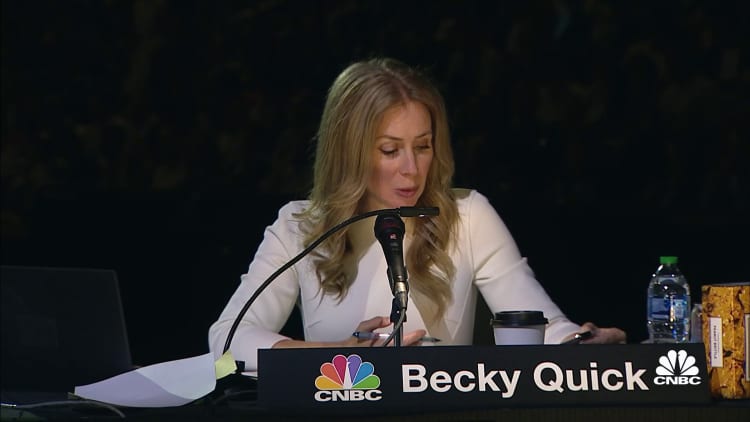

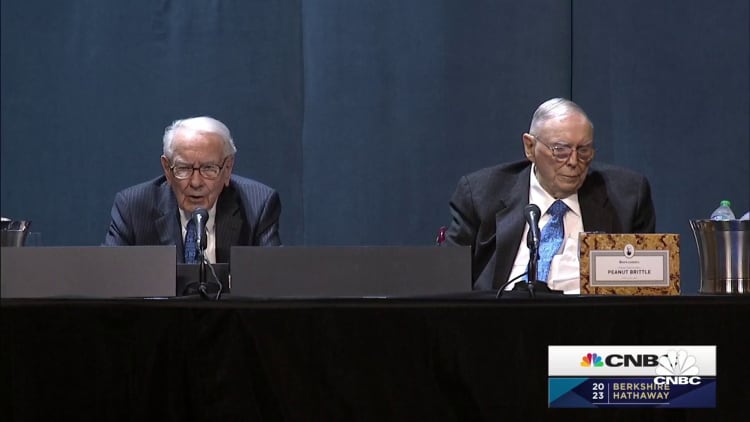

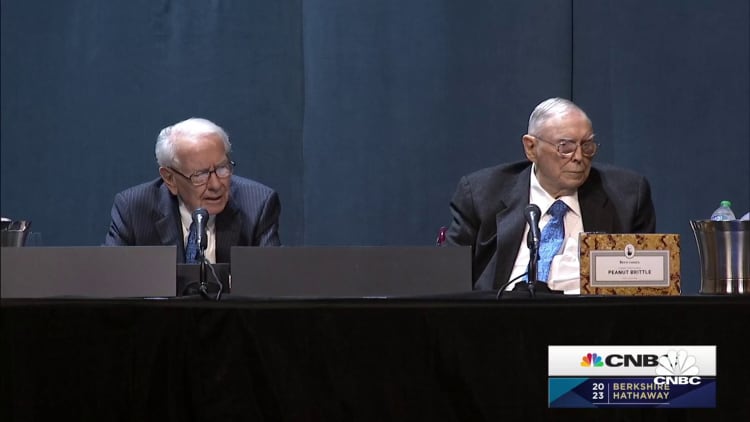

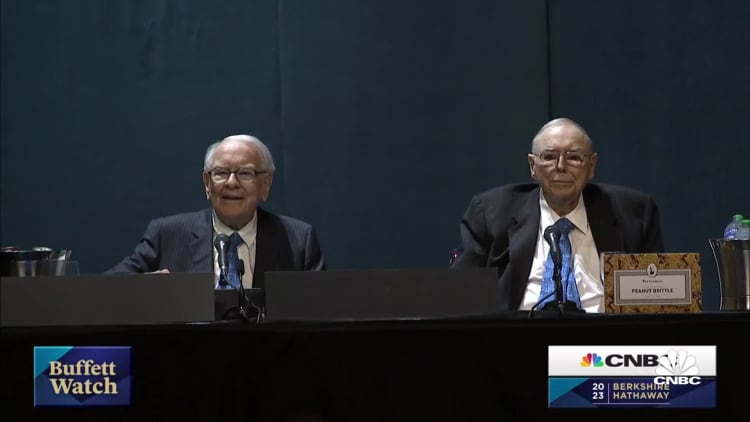

Despite the recent market volatility and worries over the economy, Berkshire Hathaway CEO Warren Buffett on Saturday provided a calm and steady voice as he fielded questions from shareholders.

That's not to say that Buffett doesn't see some turbulence ahead. He said commercial real estate could struggle with higher borrowing rates and banks could face more pressure but noted that deposits were safe. As for the economy, Buffett noted that his businesses will see lower year-over-year earnings as economic activity slows down.

The Oracle of Omaha also said Berkshire Hathaway wouldn't take over Occidental Petroleum.

"There's speculation about us buying control, we're not going to buy control. … We wouldn't know what to do with it," he said.

The legendary investor sounded more optimistic about the prospects of value investing, however.

"In the 58 years we've been running Berkshire, I would say there's been a great increase in the number people doing dumb things, and they do big dumb things," he said, meaning that there will be more opportunities to make money down the road.

Buffett also doesn't expect the U.S. dollar to be dethroned as the world's reserve currency anytime soon.

"We are the reserve currency, I see no option for any other currency to be the reserve currency," he said.

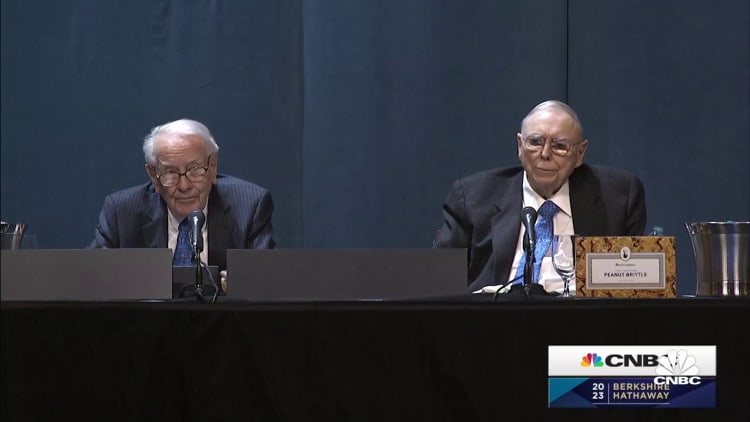

The 99-year-old Charlie Munger, Buffett's right-hand man, also commented on artificial intelligence. He said that, while "going to see a lot more robotics in the world," he remains "skeptical of some of the hype in AI."

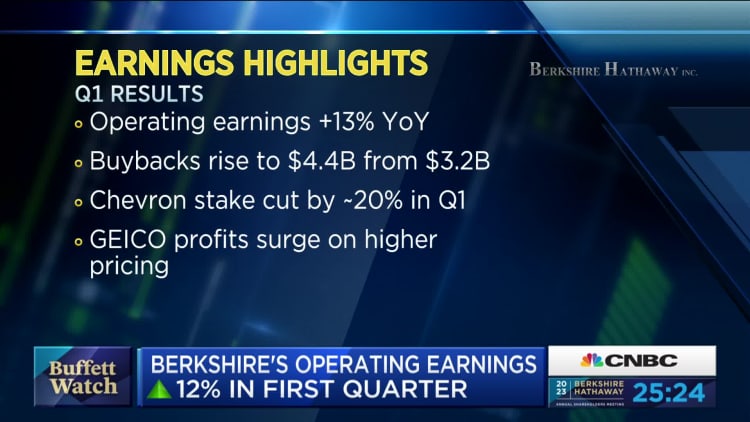

Here are some of the highlights:

- Buffett says there's 'no option' for reserve currency besides U.S. dollar

- Buffett says Apple is different — it is 'a better business than any we own'

- Sometimes portfolio diversification is 'deworsification,' Munger says

- Commercial real estate starting to see the consequences of high borrowing rates, Buffett says

- Charlie Munger says 'old fashioned intelligence works pretty well' over AI