Issues with finances can be a major hurdle in romantic relationships, with nearly a third (30%) of couples dealing with financial infidelity in the past year, according to a recent survey from U.S. News & World Report.

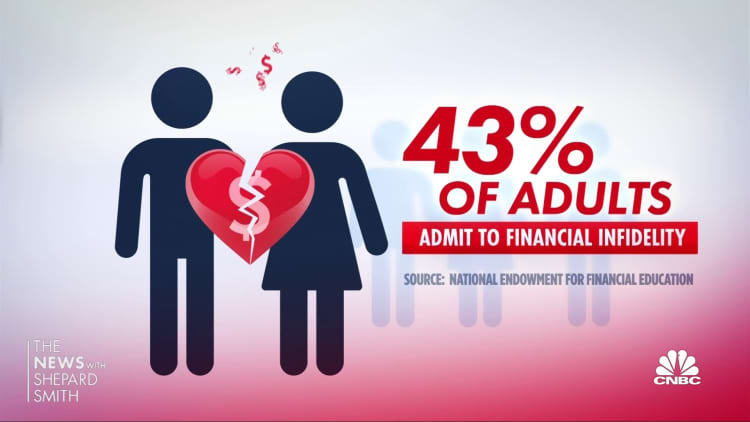

Similar to romantic infidelity, financial infidelity is when a partner deliberately chooses not to tell the truth, but in this case it regards something around money.

While financial infidelity can certainly take on several forms, the survey findings identified that the biggest money-related lies that came up in relationships were secretive purchases (31.4%), hiding debts (28.7%) and dishonesty about income (22.6%).

These numbers help paint a bigger picture of how strong of an impact money has in our partnerships. A key part in overcoming lying to your spouse about the huge amount of credit card debt you may have, or your partner being dishonest about how much money they really make, is to get a better understanding of your own, and each other's personal finance management skills.

"Couples are likely to have varying levels of financial literacy," Beverly Harzog, credit card expert at U.S. News & World Report, tells Select. "The important thing is that they grow together and are able to make compromises when it comes to budgeting and spending. There are so many resources available for increasing your financial knowledge, such as books, websites and free apps."

In short, being well-versed together in how your money works and where your money goes can help you avoid any financial infidelity down the line. From chipping away at debt, to being proactive about budgeting, it's vital to take advantage of resources to get on the same page with each other.

Our best selections in your inbox. Shopping recommendations that help upgrade your life, delivered weekly. Sign-up here.

There's a strong correlation between financial infidelity and major debt loads

For many couples, carrying the weight of debt can make or break a relationship — especially when one partner doesn't know about the other's financial burden.

According to the U.S. News survey, over half of couples who experienced financial infidelity also happened to be in major debt. On the flip side, of those who didn't experience financial infidelity, only 22.7% were in debt.

Tackling your debt, or at least talking openly about it with your partner, is a good first step in getting on the same page. "Couples need to be in agreement when it comes to debt reduction," Harzog says. "You're setting a joint financial goal and you need to work together to make it happen."

What to do if you or your partner has credit card debt

"Most major [credit card] issuers do have apps to help you track spending," Harzog says. "If you still have a very good credit score, consider using a balance transfer credit card to get out of debt. Once you choose a strategy for getting rid of debt, decrease expenses to help you reach your goal."

Balance transfer cards offer no interest on balance transfers for a set period of time — usually for at least six months and up to 21 months. During the introductory 0% APR period, you can pay off debt without paying costly interest charges. For example, both the Citi® Diamond Preferred® Card (see rates and fees) and the Citi Simplicity® Card offer an introductory 0% APR for 21 months on balance transfers from the date of the first transfer (after, a 18.24% - 28.99% variable APR on the Citi Diamond Preferred and a 19.24% - 29.99% variable APR on the Citi Simplicity). All transfers must be completed in the first 4 months.

Citi Simplicity® Card

Rewards

None

Welcome bonus

None

Annual fee

$0

Intro APR

0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening.

Regular APR

19.24% - 29.99% variable

Balance transfer fee

There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

Foreign transaction fee

3%

Credit needed

Excellent/Good

See rates and fees. Terms apply. Read our Citi Simplicity® Card review.

Another good option that lets you also earn cash back on your spending is the Citi Double Cash® Card. This card offers zero interest on balance transfers for the first 18 months (after, 19.24% - 29.24% variable APR). Cardholders earn 2% cash back on all eligible purchases (1% when they buy and an additional 1% after they pay their credit card bill). Keep in mind that once the 0% APR intro period is up, interest will kick in, so you want to make sure you pay off your balance within that interest-free time.

Citi Double Cash® Card

Rewards

Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24

Welcome bonus

Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

Annual fee

$0

Intro APR

0% for the first 18 months on balance transfers; N/A for purchases

Regular APR

19.24% - 29.24% variable

Balance transfer fee

For balance transfers completed within 4 months of account opening, an intro balance transfer fee of 3% of each transfer ($5 minimum) applies; after that, a balance transfer fee of 5% of each transfer ($5 minimum) applies

Foreign transaction fee

3%

Credit needed

Fair/Good/Excellent

See rates and fees. Terms apply.

Read our Citi Double Cash® Card review.

What to do if you or your partner has student loans

Does your spouse need some motivation to finally make a dent in their student loan debt?

Apps like Chipper have a special round-ups feature that allows users to chip away at their student loans by applying the spare change from their everyday purchases. This tool, which is to be used on top of users making the minimum monthly payment on their student loans, will make sure you are constantly putting money toward your loans without having to think much about it.

Chipper can also help you or your partner draw out a strategy to pay off student loans by connecting the user to forgiveness programs and income-driven repayment plans to potentially help lower the monthly payments.

For private student loan borrowers, it's worth considering refinancing your student loans for a lower interest rate — especially now with the expectation that we'll see rate increases come March. When you refinance your student loans, you get a chance at scoring a lower rate, plus you can extend or shorten your loan term depending on how quickly you want to pay off your loans. This could make your monthly payments more manageable and save you money in the long run.

SoFi Student Loan Refinancing is a great option for borrowers looking to refinance. To get even better refinancing terms or lower rates, applicants with a lower credit score can also apply with a co-signer.

Catch up on Select's in-depth coverage of personal finance, tech and tools, wellness and more, and follow us on Facebook, Instagram and Twitter to stay up to date.