The coverage on this live blog has ended — but for up-to-the-minute coverage on the coronavirus outbreak, visit the live blog from CNBC's Asia-Pacific team.

- Global cases: More than 2,047,700

- Global deaths: At least 133,354

- US cases: More than 632,800

- US deaths: At least 27,850

The data above was compiled by Johns Hopkins University.

All times below are in Eastern time.

8:15 pm: San Francisco launches its own contract tracing program

The city of San Francisco is creating a new contract tracing program — currently in the testing phase — which is designed to track and monitor people who are potentially infected with Covid-19.

The city is working on it with UCS faculty and over 50 people including San Francisco librarians, city attorney staff and UCSF medical students. Those workers, who are being trained for responding, will follow up remotely with any individuals who may have been in contact with the Covid-positive patient. It's on a voluntary basis, which means people need to be able to trust the process, city officials said. "There have been instances in San Francisco when people have been unwilling to work with contact investigators, either because they do not trust them, do not understand the purpose, or do not have all the information they need to feel comfortable," city officials said. —Jennifer Elias

7:50 pm: San Francisco city workers take 'emergency' roles in pandemic

Hundreds of San Francisco city government workers have been drafted as "disaster service workers," the San Francisco Examiner reported Wednesday.

The city requires its employees to help out where needed if a disaster occurs. The city has mobilized employees from librarians to election staffers to take on roles they may not normally in their day jobs.

Since early April, approximately 75 librarians have been in charge of making sure seniors and low-income families have food on their plates, according to the report. Park and Recreation staffers are providing childcare to hospital and frontline workers, San Francisco mayor London Breed tweeted Wednesday.

7:30 pm: LA mayor says large gatherings likely banned for the rest of the year

Los Angeles Mayor Eric Garcetti said Wednesday large gathering such as concerts and sporting events likely won't resume until 2021. "It's difficult to imagine us getting together in the thousands anytime soon, so I think we should be prepared for that this year," Garcetti said in an interview with CNN's Wolf Blitzer. "Until there's either a vaccine, some sort of pharmaceutical intervention, or herd immunity, the science is the science. He added that public health officials made clear it has "miles and miles to walk before we can be back in those environments." —Jennifer Elias

7:02 pm: Apple and Google have an ambitious plan to help officials track the virus

Rival tech giants Google and Apple have teamed up to create technology to help health officials trace who's been infected by Covid-19, and are building it directly into iOS and Android, the two operating systems that power almost 100% of the world's smartphones.

It's a big announcement — not only is it an unusual example of two tech giants working together, but digital contact tracing is a technology that is being closely watched to see if it can help schools and businesses re-open when the Covid-19 epidemic slows down.

It's a digital version of traditional contact tracing, a labor-intensive process in which public health officials contact everyone who might have been exposed to someone infected with Covid-19 to tell them to self-isolate or get tested. Contact tracing is a big part of mitigation efforts in Hong Kong and Taiwan, for example. —Kif Leswing

6:51 pm: Another 5 million unemployment claims could be tallied, but the job-loss trend may be peaking

Economists expect a fourth week of claims in the multi-millions, the result of the abrupt shutdown of the economy that started in the second half of March to stop the spread of coronavirus. In the prior three weeks, the number of claims totaled 16.8 million.

According to Dow Jones, economists' consensus forecast is 5 million for the week ended last Saturday, down from 6.6 million the week earlier.

The stay-at-home orders and unprecedented shutdown of business activity hit the leisure and entertainment industry and retail workers hard, as restaurants, stores and other venues where crowds gather were closed to prevent the spread of the virus. —Patti Domm

6:44 pm: Alphabet CEO tells employees the company will slow hiring and other investments

Alphabet, the parent company of Google, is pulling back on some of its investments for the rest of the year amid the Covid-19 crisis and it's starting with hiring.

"We believe now is the time to significantly slow down the pace of hiring, while maintaining momentum in a small number of strategic areas where users and businesses rely on Google for ongoing support, and where our growth is critical to their success," CEO Sundar Pichai told workers this week in a memo first reported by Bloomberg.

A spokesperson confirmed the slowdown in a statement to CNBC. "We'll be slowing down the pace of hiring, while maintaining momentum in a small number of strategic areas, and onboarding the many people who've been hired but haven't started yet." —Jennifer Elias

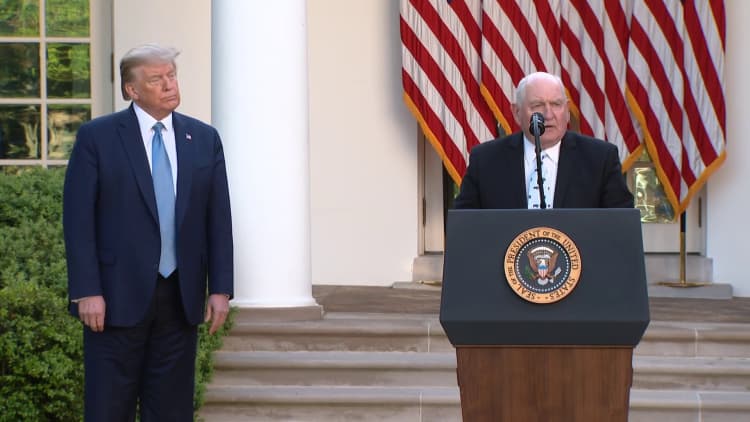

6:37 pm: Trump says US has 'passed the peak' of outbreak

President Donald Trump said the U.S. has "passed the peak" of the coronavirus outbreak, which has infected more than 632,000 people in America.

"While we must remain vigilant, it is clear that our aggressive strategy is working," Trump said at a news briefing with the White House coronavirus task force. "The battle continues, but the data suggests that nationwide we have passed the peak on new cases."

Trump said new cases are "declining" in New York, which has more confirmed cases than any country outside the U.S. He added that cases are "flat" in Denver and Detroit, while other cities including Baltimore and Philadelphia "are showing great signs of success." —Will Feuer

6:27 pm: WHO says changing climates and crowded cities drive disease outbreaks

There is "no question" that changes in temperature, rainfall and humidity are driving infectious disease outbreaks around the world, but the impact of rapidly changing weather systems on the coronavirus are not yet known, World Health Organization officials said.

Even though scientists are still learning about Covid-19, the virus has shown the capability to "accelerate in a number of different climates," Dr. Maria Van Kerkhove, head of WHO's emerging diseases and zoonosis unit, told reporters during a press conference at the agency's headquarters in Geneva.

"If you remember, this began in very cold temperatures, very dry temperatures, very low-level humidity," she said. "We don't know how this virus is impacted completely yet."

China reported its first known cases of the coronavirus to the international health agency on Dec. 31 when parts of the country were in the middle of the winter season. Since then, the virus has spread to nearly to every country across the globe and infected more than 2 million people in a range of different environments.—Berkeley Lovelace Jr.

6:15 pm: Stock futures flat after Dow's 445-point slide, investors await jobless claims data

Futures contracts tied to the major U.S. stock indexes opened flat at the start of the overnight session as investors awaited key jobless claims data on Thursday.

Dow Jones Industrial Average futures dropped 42 points shortly after the opening of extended trading, implying an opening fall of 40 points.

S&P 500 and Nasdaq futures also held around flatline. —Thomas Franck

6:05 pm: United expects $5 billion in government aid to weather coronavirus

United Airlines expects to receive $5 billion in government coronavirus relief — $3.5 billion as grants and $1.5 billion as a low-interest loan — help it through a sharp drop in demand because of the disease.

Chicago-based United joins American, Delta, JetBlue and others that have reached agreements in principle with the U.S. government over the conditions for their share of $25 billion in payroll grants, which require airlines not to furlough or cut the pay rates of their employees through Sept. 30, even as demand drops to the lowest level in decades.

United said it also expects to issue warrants to the U.S. government to purchase around 4.6 million of United's common stock, a stake that would allow the government to acquire close to 1.9% of the airline, based on FactSet data. The funds will "cover a portion" of the company's pay and benefits costs until Oct 1, United spokesman Frank Benenati said in a release.

"This financial support is critical to our people, who are ensuring air service to communities throughout the country and supporting the shipment of much-needed medical supplies and travel of health care professionals around the globe," he said —Leslie Josephs

5:50 Map shows US topping 630,000 cases

5:30 pm: Gov. Newsom announces more benefits for unemployed Californians amid coronavirus pandemic

California Gov. Gavin Newsom announced additional unemployment benefits for the state on Wednesday as well as new measures to handle a record volume of unemployment inquiries.

"People are not where they were just a few weeks ago," Newsom said at a press briefing Wednesday. "Just in the last four weeks, 2.7 million Californians have formally filed for unemployment insurance."

Newsom said California is now setting up the federal government's Pandemic Unemployment Assistance program, which will provide benefits for certain unemployed individuals, including those who are self-employed, gig workers and independent contractors. There are 1.5 million self-employed California residents "also deserving of direct assistance," according to Newsom. —Hannah Miller

5:24 pm: Drinking alcohol can make the coronavirus worse, the WHO says

Drinking alcohol can increase the risk of catching Covid-19 and make it worse if you do get it, the World Health Organization said, recommending that government leaders around the world limit its access during coronavirus lockdowns.

"Alcohol compromises the body's immune system and increases the risk of adverse health outcomes," the WHO's regional office for Europe said on its site late Tuesday, citing heavy alcohol use throughout the continent.

Alcohol consumption is associated with a number of communicable and noncommunicable diseases, which can make a person more vulnerable to contracting Covid-19. It can also exacerbate mental health issues, risk-taking behavior and stoke violence, especially in countries that have implemented social distancing measures that largely keep the population quarantined in their homes. —William Feuer

5:20 pm: New Orleans extends stay-at-home order

New Orleans Mayor LaToya Cantrell issued an order extending the city's stay-at-home policy until May 16.

The order continues the closure of nonessential businesses and limits restaurant operations to take-out and delivery. Louisiana Gov. John Bel Edwards issued a stay-at-home order for the state on April 2 that is only in place through April 30. —Hannah Miller

5:15 pm: Applying for small business loans has been tough. But not for these people

A forgivable loan program meant to help ailing small businesses has met with much criticism amid delays, confusion and frustration.

But some small-business owners have successfully applied for the loans, made through the new Paycheck Protection Program, with hardly a hiccup.

These entrepreneurs appear to have something in common: relationships with representatives inside their bank who helped guide them through the process.

Lawrence Sprung, a certified financial planner and financial advisor, was one such owner.

Sprung, the president of Mitlin Financial, based in Hauppauge, New York, applied for a $50,000 loan on April 3, the day banks began taking applications.

Others weren't as fortunate. Many were locked out due to heavy volume or the absence of a relationship with a bank credentialed to be part of the loan program. —Darla Mercado, Greg Iacurci

5:09 pm: Goldman says fewer 'loss of smell' Google queries suggest better COVID outlook

Goldman Sachs is optimistic that recent public safety measures to contain the spread of the coronavirus are working based on an unusual data source: Google searches for "loss of smell."

Queries for "loss of smell" on the internet search giant spiked in the week that began March 22 to an intensity reading of 100. That means that U.S.-based searches for the phrase "loss of smell" peaked relative to any other period in the last 12 months during the last full week of March.

Since then, however, Google searches for "loss of smell" have more than halved, a sign Goldman Chief Economist Jan Hatzius says could suggest a fall in official case counts over the next few weeks.

"The latest data on the pace of virus spread are encouraging, suggesting that lockdowns have paid large dividends," Hatzius wrote Wednesday. "Measures of virus spread based on big data are even more encouraging and suggest that the true number of new cases actually peaked a while ago."

"Google searches for 'loss of smell' — a symptom that has proven an effective way to track the virus spread — have fallen to roughly one-seventh of their peak US level," he added. "These measures appear to lead the official count of cases confirmed by testing by 2-3 weeks."

The latest Google search data as cited by Goldman Sachs suggests that U.S. queries for "loss of smell" have fallen to about 15% of their peak level. —Thomas Franck

4:50 pm: IRS stimulus check tracking tool is not working for some people

A tool launched Wednesday by the Internal Revenue Service to track Americans' stimulus relief checks is not working for many, according to individuals who reached out to CNBC Make It.

The Get My Payment tool is meant to give those eligible for a coronavirus stimulus check information on when they will receive their payment. Instead, many are receiving messages that their payment status is not available.

In most cases, this happened because the system was overloaded, Luis Garcia, an IRS spokesperson, told CNBC Make It.

"What happened is instead of having an error message or a message saying the system is very busy, it just says your information isn't in here, that was the default," says Garcia. But that should be fixed now.

"Just be patient, check back later," he says. "If you filed last year's or this year's taxes we have your information." —Alicia Adamczyk

4:38 pm: Trump's WHO funding threat echoes action that got him impeached, Democrats say

President Donald Trump's first step toward pulling World Health Organization funding during the coronavirus pandemic has set the stage for another legal tug of war with House Democrats wary of him treading on their power.

Facing sustained backlash for his handling of the outbreak as U.S. Covid-19 cases top any other country in the world, the president on Tuesday criticized the United Nations agency for what he called its "role in severely mismanaging and covering up the spread of the coronavirus." Trump said he was "instructing [his] administration to halt funding" to the WHO during a 60 to 90-day review period.

House Democrats argued that suspending funding would hamper the global response to the disease ripping across the globe. They also contended he cannot withdraw money already appropriated by Congress under its constitutional authority — suggesting a court fight over Trump's power looms if he pulls funding.

"This decision is dangerous, illegal and will be swiftly challenged," House Speaker Nancy Pelosi said in a statement Wednesday. —Jacob Pramuk

4:30 pm: JC Penney says it skipped a $12 million interest payment as outbreak shutters stores

J.C. Penney said Wednesday that it has chosen not to make a roughly $12 million interest payment due on April 15, as the coronavirus pandemic takes a toll on its business.

It is entering into a 30-day grace period "in order to evaluate certain strategic alternatives, none of which have been implemented at this time," Penney said in a filing with the Securities and Exchange Commission.

If the company does not make the payment within the 30-day period, it would result in an "event of default," with respect to its 2036 Senior Notes, the department store chain said.

Among Penney's options is filing for bankruptcy protection, a person familiar with the matter told CNBC.

Even before the coronavirus pandemic forced the retailer to close all of its stores, Penney was already facing slumping sales and looming debt payments that include significant annual interest expenses.

"The Coronavirus (COVID-19) pandemic has created unprecedented challenges for department store retailers across the industry and has resulted in extensive store closings," a spokeswoman told CNBC in an emailed statement. —Lauren Thomas

4:26 pm: Elizabeth Holmes' criminal trial delayed

Elizabeth Holmes, the once heralded visionary who claimed to revolutionize blood testing in America, got her fate delayed when a judge set a new trial date of Oct. 27 due to the coronavirus pandemic.

As the economy is screeching to a halt and millions are scrambling to get tested for whether they have the virus, a judge said it's impossible to keep Holmes' original trial date in July.

"We're in unchartered waters and unchartered territories," U.S. District Judge Edward Davila said. "We need to make sure the environment is safe for all parties, including the jury that's called to hear the matter."

The judge said he would consider moving the trial to early 2021 if the coronavirus remains a threat in the fall.

In a status memo filed this week, attorneys for Holmes pointed to the dangers of conducting such a high-profile trial amid a health pandemic. —Yasmin Khorram

4:07 pm: Dow drops more than 400 points as the coronavirus fuels deeper worries over the economy

Stocks fell sharply as dismal economic data and weak bank earnings fueled concerns over the coronavirus's impact on the U.S. economy.

The Dow Jones Industrial Average dropped 442 points, or 1.9%. The S&P 500 slid 2.2% while the Nasdaq Composite closed 1.4% lower.

Bank of America closed more than 6% lower on the back of disappointing earnings. Citigroup fell more than 5%. Energy, materials and financials were the worst-performing sectors in the S&P 500, dropping more than 4% each.

Retail sales during the month of March plunged a record 8.7%, according to a report from the Commerce Department published Wednesday. That was the largest one-month decline since the department began tracking the series in 1992.

"If this is a precursor to what we can expect throughout the U.S. ... there's no word for it," said Quincy Krosby, chief market strategist at Prudential Financial. "The reflects the complete shutdown of the economy." —Fred Imbert

3:34 pm: Executives warn Trump that Americans need more testing before returning to work, shopping, eating out

A group of business executives warned President Donald Trump on Wednesday that the federal government "needed to dramatically increase" the availability of coranavirus testing before Americans would feel comfortable returning to their normal lives, according to a new report.

The Wall Street Journal, citing people familiar with the situation, said Trump held a conference call with about three dozen financial, food and beverage, hospitality and retail industry executives who are part of a new task force that will advise him on reopening the country.

It was the first of four planned calls involving task force members.

"The people involved in the first call ... described current testing levels in the U.S. as inadequate to effectively reopen the economy," the Journal reported. —Dan Mangan

3:07 pm: Maryland governor orders residents to wear masks in retail stores

Maryland Gov. Larry Hogan signed an executive order requiring masks or face coverings to be worn in retail locations, including grocery shops, pharmacies and convenience stores.The order goes into effect Saturday.

"This is really another important step in our immediate efforts to protect public health and safety," Hogan said. "The wearing of masks is also something that we may have to become more accustomed to in order to safely reopen our state."

Essential retailers will also have to require employees to wear face coverings. Masks will also be required on public transportation. —Hannah Miller

2:28 pm: French death toll rises, intensive care numbers down

The number of people who died in France from the coronavirus infection in hospitals and nursing homes reached 17,167, the head of the public health authority said.

The total death toll stood at 15,529 on Tuesday.

The number of people in intensive care units fell to 6,457, a drop of 273, director general of health Jerome Salomon said. It was the seventh consecutive day of declines, suggesting the national lockdown, extended to May 11 on Monday, is having positive effects in containing the disease. —Reuters

2:21 pm: Fed Beige Book says economy contracted 'sharply and abruptly' due to coronavirus

Economic activity has showed a deep decline due to measures taken during the coronavirus scare, with leisure and hospitality as well as retail the hardest-hit so far, according to the Federal Reserve's latest Beige Book report.

The report also said most areas saw manufacturing declines that varied among industries. Food and medical product producers saw strong demand but faced obstacles in production and supply chains.

"Economic activity contracted sharply and abruptly across all regions in the United States as a result of the COVID-19 pandemic," the report said. "All Districts reported highly uncertain outlooks among business contacts, with most expecting conditions to worsen in the next several months."

Released periodically through the year, the Beige Book surveys the Fed's 12 districts for activity across sectors. —Jeff Cox

2:13 pm: Small business loans top $296 billion and could reach the program's limit by the end of Wednesday

Much-needed small business aid is beginning to trickle out and more is expected in the weeks to come as banks start to disburse the rescue funds to Main Street. But the first-come, first-serve Payroll Protection Program of $349 billion in aid may be nearing a ceiling for loan commitments, with more than 1.3 million loans given approval at a value of more than $296 billion through Wednesday afternoon, according to the Small Business Administration.

The program could reach its funding limit by the end of the day, according to a source familiar with the matter.

The SBA and Treasury Department have yet to release any formal statistics on total loan disbursements from banks to small business owners, with one senior administration official telling CNBC the information is not yet available, despite multiple requests. The SBA did release data showing the average loan size is just under $240,000. —Kate Rogers, Betsy Spring

2:03 pm: 'We need to start saving individual people,' not just stockholders, says pension fund CIO

The chief investment officer of one of the country's biggest public pension funds said the government response to the coronavirus should be focused on supporting unemployed workers, not stocks owned by pensioners.

"I don't buy in to just [saving] the pensioners. Yes, they're important, but they're a small percentage. I think we have to start saving individual people," Christopher Ailman of CalSTRS said on "Squawk Box."

The $2.2 trillion CARES Act passed by Congress and other actions by the Federal Reserve have created an unprecedented economic support from the U.S. government as the coronavirus pandemic shut down large parts of the economy.

On Tuesday, the major airlines and the Treasury Department struck a deal on how the companies could receive payroll support to stay afloat and keep workers employed.

Ailman said it is "such a tough call" as to which companies should be helped, but he said the total amount would likely have negative economic effects long-term. —Jesse Pound

1:52 pm: New government app shows you the status of your stimulus payment

Millions of Americans are slated to get payments of up to $1,200 per person from the government this week, and now there's a way to track your money.

On Wednesday, the Treasury Department and IRS launched a new free web app called "Get My Payment" that allows taxpayers to find the status of their payment.

It also enables taxpayers to add their direct deposit information if they did not include that in their tax returns for 2018 or 2019.

In the first hours after launch, many users complained on social media that they were having a difficult time getting through. Others who accessed the site still were not able to get their payment status. —Lorie Konish

1:45 pm: Oracle's Larry Ellison says Zoom is an 'essential service' as virus forces remote work

Oracle founder and chairman Larry Ellison gave Zoom high praise this week, calling it an "essential service" for his business and others around the world.

Zoom has seen enormous growth as more and more workers have been instructed to stay at home during the coronavirus pandemic. Zoom said its daily users spiked to 200 million in March compared with 10 million in December. The service's growth has been credited in part to its availability across many different platforms and it's free use for calls up to 40 minutes.

Ellison said in the video posted Monday he believes Zoom will continue to be an important to businesses once workers return to the office. —Lauren Feiner

1:37 pm: New York Gov. Cuomo orders all people to wear masks or face coverings in public

New York Gov. Andrew Cuomo plans to issue an executive order requiring all people to wear a mask or face covering while in public as the state works to combat the worst coronavirus outbreak in the U.S.

"If you are going to be in a situation, in public, where you come into contact with other people in a situation that is not socially distanced you must have a mask or a cloth covering nose and mouth," Cuomo said during a press conference in Albany.

Cuomo said the state is moving to a "new normal" as he outlined a gradual reopening of businesses, saying the crisis won't be over until a vaccine is made available.

"Where we're going, it's not a reopening in that we're going to reopen what was. We're going to a different place," Cuomo said. —Noah Higgins-Dunn

1:31 pm: CEO of mortgage giant Quicken Loans explains how struggling homeowners can 'skip the payment'

One of the biggest questions for homeowners facing a coronavirus-related financial hardship is whether to try to pause their mortgage payments.

Quicken Loans CEO Jay Farner told CNBC the company wants to educate people that if they "skip the payment," they'll still have to pay it eventually.

"Our tool right now is something called 'forbearance,'" Farner said on "Squawk Box." "It gives you the opportunity to pause on making your mortgage payments [with] no impact on your credit. But at some time in the future, you have to catch those back up."

Many of the nation's top mortgage issuers, of which Quicken Loans is the largest, are working with clients to help them get through the coronavirus-driven economic halt.

Requests to delay mortgage payments grew by 1,270% between the week of March 2 and the week of March 16, and another 1,896% between the week of March 16 and the week of March 30, according to numbers released Tuesday by the Mortgage Bankers Association. —Matthew J. Belvedere

1:24 pm: A majority of publishers say advertisers have canceled or paused campaigns, says new IAB survey

The vast majority of online publishers in the U.S. say they've had advertisers cancel or pause ad campaigns with them as the coronavirus pandemic and lockdown hurts advertisers, according to results of a new Internet Advertising Bureau survey. The advertising cutback is resulting in widespread layoffs and cost cuts even as media consumption is skyrocketing.

The effects are being felt across ad-supported websites, as well as companies that provide technical infrastructure to support selling ads.

The IAB said it surveyed more than 200 U.S. ad-supported publishers, programmatic providers and media platforms who are both members and non-members of the organization. The survey examined both publishers covering hard news as well as other ad-supported media, like cooking or financial advice sites.

Of those, 98% of respondents said they're expecting a decrease in revenue in 2020. —Meg Graham

1:12 pm: Half of the world has asked the IMF for a bailout, chief says

The global economic downturn has been so severe that already half of the world has asked the International Monetary Fund for a bailout, the organization's chief said.

"This is an emergency like no other. It is not because of bad governors or mistakes," Kristalina Georgieva told CNBC's Sara Eisen on CNBC's "Squawk Alley." "For that reason, we are providing funding very quickly."

"We are asking for one thing only: Please pay your doctors and nurses, make sure that your health [care] systems are functioning, and that vulnerable people and first responders are protected," Georgieva said.

Georgieva comments came after the IMF said Tuesday it expects the global economy to contract by 3% this year, adding the world could see a 1930's style recession. The fund had forecast a 3.3% economic expansion for 2020 in January. —Fred Imbert

1:01 pm: How Germany plans to gradually reopen its economy after a weeks-long coronavirus shutdown

Chancellor Angela Merkel Wednesday laid out Germany's plan to gradually resume public life while maintaining social distancing, a month after Europe's largest economy effectively shut down in an effort to slow the coronavirus outbreak.

Some small businesses will reopen on April 20 while schools will begin to gradually reopen on May 4. Most businesses have been closed in Germany since a March 16 government order limited economic life to grocery stories, pharmacies, banks, gas stations and other essential services while people were urged to remain at home.

The German government extended social distancing measures until May 3, which require people to maintain a distance of 1.5 meters (5 feet) and limit public gatherings to just two people with the exception of family members. Large gatherings will remain banned at least until August 31, and religious gatherings remain prohibited until further notice. Germans are also being encouraged to wear masks in public and avoid travel.

Businesses that don't exceed 800 square meters are allowed to reopen, as well as car dealerships, bike shops and bookstores regardless of their size. Hair salons can reopen on May 4 but workers must wear personal protective equipment. All shops that reopen must adhere to regulations on hygiene and must prevent lines from forming.

Restaurants will remain closed to dine-in service, but can offer delivery and takeout. Bars, clubs, theaters and concert venues will remain closed. Companies are encouraged to continue working for home whenever possible. —Spencer Kimball

12:48 pm: Schumer, Pelosi staff to discuss next coronavirus relief bill with Treasury

Staffers for Senate Minority Leader Chuck Schumer and House Speaker Nancy Pelosi will meet with the Treasury Department on Wednesday— to discuss the Democrats' push to pass additional coronavirus relief legislation.

The new round of working-level negotiations between Democrats and members of the Trump administration indicates a potential thaw in the ongoing stalemate over emergency funding.

It also reflects a desire on both sides to keep the government's fiscal spigot open and pouring money into the economy, which has been devastated by the disease and the strict policies imposed to slow its spread.

Schumer, D-N.Y., spoke with Treasury Secretary Steven Mnuchin on Wednesday morning about the "interim" relief package, a spokesman for the Senate leader's office told CNBC. —Kevin Breuninger

12:31 pm: American Airlines CEO: 'It certainly feels like we're at bottom' as revenue tumbles 90%

The record drop in air travel demand because of the coronavirus pandemic appears to be as bad as it's going to get, American Airlines CEO Doug Parker said.

"It certainly feels like we're at the bottom," Parker told CNBC in an interview. "Our revenues are down 90% on a year-over-year basis and they've been that way now for a few weeks. The real question is how long you stay at the bottom and when do we begin to recover. I don't think I know that better than anybody else."

American and other large U.S. airlines, including Delta, Southwest and JetBlue on Tuesday announced agreements with the Treasury Department on the terms for their share of $25 billion in government grants and low-interest loans.

American said the Treasury Department approved $5.8 billion in assistance — a $4.1 billion grant and a $1.7 billion low-interest loan. The Fort Worth, Texas-based carrier said it plans to apply for another government loan of around $4.75 billion. —Leslie Josephs

12:19 pm: The economic data is even worse than Wall Street feared: 'The economy is clearly in ruins here'

Consumer and manufacturing reports for March showed the hit to the economy from the coronavirus was even swifter and deeper in the early weeks of the shutdown than expected.

March retail sales fell 8.7%, the most ever in government data, and New York regional manufacturing activity hit an all-time low, declining a shocking 78.2%. Industrial production slipped 5.4% and manufacturing was down 6.3%, a record reflecting in part the 28% decline in auto production as plants shut down.

The economic reports showed the double whammy of state shutdowns in mid-March on two pillars of the economy — the consumer and business. Both reports were even more dire than expected, and foreshadow even worse declines in April's activity, with state shutdowns affecting areas responsible for more than 90% of the economy. —Patti Domm

12:10 pm: Insurance companies offering drivers relief during the coronavirus pandemic

With millions under stay-at-home orders and working remotely, American roadways are seeing a lot less congestion and accidents. That means less risk of insurance claims — and auto insurers are taking note.

Just over 80% of American auto insurance companies have announced that they will refund or credit drivers more than $6.5 billion over the next two months, according to a new report from the Consumer Federation of America.

But those refund programs vary widely from insurer to insurer. Initiatives from State Farm and American Family received high marks from the consumer advocacy group for the amount of relief offered and the speed at which it's promised to be delivered. However, others fell short.

CNBC Make It rounded up a list of insurance companies that have announced initiatives for drivers during the current coronavirus health crisis. Keep in mind that some insurers are providing relief on a case-by-case basis and you may not qualify for all of the programs. —Megan Leonhardt

12:02 pm: McDonald's relationship with US franchisees is fraying over coronavirus relief

The coronavirus pandemic is straining McDonald's relationship with its U.S. franchisees once again.

The fast-food giant is pushing for franchisees to do more to protect their workers, while franchisees are asking for more financial relief to keep them afloat. Franchisees operate 95% of McDonald's 14,000 U.S. restaurants.

McDonald's is deferring rent for three months for franchisees to lessen the financial blow of social-distancing measures. Only about one-third of its U.S. franchisees will be asked to pay March rent. Operators who have seen the sharpest sales drops are also receiving deferrals on service fees.

Tensions between the National Owners Association and McDonald's management have flared up in the past month, based on correspondence between the two viewed by the Wall Street Journal. McDonald's U.S. franchisees formed the independent group in 2018 to push back against the Chicago-based company's discounts and renovation plans.

The NOA told McDonald's management in a letter last week that its members and most of the company's franchisees are "increasingly losing faith in the partnership and company leadership," according to the Journal. —Amelia Lucas

11:53 am: WHO 'regrets' Trump's decision to withhold funding, says focus is on saving lives in coronavirus pandemic

The World Health Organization is turning to other countries to help fill any gaps in financing its Covid-19 response work after U.S. President Donald Trump said the United States would withhold contributions.

"The United States of America has been a long-standing and generous friend to the WHO and we hope it will continue to be so," WHO Director-General Dr. Tedros Adhanom Ghebreyesus said at a press conference. "We regret the decision of the President of the United States to order a hold in funding to the World Health Organization."

Trump announced Tuesday that the U.S. will suspend funding to WHO while it reviews the agency's response to the Covid-19 pandemic. He said the administration will conduct a "thorough" investigation that should last 60 to 90 days.

In the fiscal year 2019, the U.S. provided about $237 million as well as an additional $656 million in voluntary contributions to the agency, according to a WHO spokesperson, representing about 14.67% of its total budget. —Berkeley Lovelace Jr.

11:45 am: New York City struggles to get accurate coronavirus fatality count as more people die at home

New York City is struggling to get an accurate count of the number of Covid-19 fatalities as more people die at home and some likely coronavirus deaths are attributed to heart attacks and other causes, Mayor Bill de Blasio said.

On Tuesday, New York City officials said they would begin counting "probable" Covid-19 deaths, which are people "who had no known positive laboratory test," but are believed to have died due to Covid-19.

The New York City Department of Health and Mental Hygiene estimates that there have been 3,778 probable Covid-19 deaths since March 11 that weren't previously counted in the city's official tally. There have been 6,589 confirmed Covid-19 deaths in New York City so far. —Will Feuer

11:33 am: How to stay safe when people are breathing heavily while running, walking outside

Taking a walk or going for a run outdoors during the Covid-19 pandemic can be a saving grace for your mental and physical health. But in a time when we're all supposed to stay inside, it might seem ironic that there are more people gathering in outdoor spaces to jog.

Running and walking outside are some of the safest activities people can do right now, "assuming they follow the actual social distancing guidelines," Dr. Aaron E. Glatt, chairman of the department of medicine and hospital epidemiologist at Mount Sinai South Nassau tells CNBC Make It.

You'll probably have to temporarily change where and when you run amid the pandemic, Dr. Ravina Kullar, infectious disease researcher and expert with the Infectious Diseases Society of America, who is also an avid runner, tells CNBC Make It. But "If you're running by yourself and you're running in an area where you're not encountering other people, it's very healthy," Glatt says.

Here's all you need to know about running, walking and exercising outdoors during Covid-19. —Cory Stieg

11:12 am: Alphabet's health company defends decision to require a Google account to use its screening site

In a letter to five Democratic senators, Alphabet's Verily explained how it would protect data collected by its coronavirus screening website and defended its decision to require users to sign in with a Google account to gain full access.

The Baseline Covid-19 website made a big splash in mid-March when President Donald Trump announced project at a press briefing that reportedly caught the Google sibling company off-guard. The idea for the site was to screen people for symptoms of the virus and direct them to nearby testing locations if they appeared to be a candidate. So far, the site has rolled out at a smaller scale initially than Trump originally suggested, having launched only in California. Verily is Alphabet's life sciences company, which is run separately from Google. —Lauren Feiner

11:09 am: El-Erian: Banks take drastic steps to avoid being seen as making money off the crisis

U.S. banks are not hesitating to set aside billions of dollars in case of coronavirus-driven loan losses because it allows them to mask substantial increases in quarterly trading revenue, Mohamed El-Erian said.

The chief economic advisor at Allianz acknowledged on CNBC that banks are certainly adding to their credit reserves in an anticipation of a wave of defaults related to the pandemic. "They expect, the IMF expects, everybody expects, the worst economic hit since the Great Depression."

"But I also think, if you've made a ton of money on trading, you really don't want to show massive profits right here," El-Erian said on "Squawk Box." "You don't want to say, 'Hey look I'm doing OK,'" while millions and millions of Americans have lost their jobs in recent weeks. —Kevin Stankiewicz

11:04 am: Online lending platform SoLo Funds opens spigot on interest-free peer-to-peer microloans

Online lending platform SoLo Funds relaunched and opens money spigot on interest-free peer-to-peer microloans for cash-strapped Americans.

It uses a new model for peer-to-peer lending. It will provide microloans of between $50 and $1,000, with terms set by the borrower. There is no interest charged for the loans on the platform.

Borrowers set their own terms, select the repayment date, how much they need, the reason they need it and what they would like to tip the individual lender. Tips are capped at 10%. —Lori Ioannou

10:54 am: 60% of employers have reduced hiring in the last month, according to new data

In the last month, amid the spread of the Covid-19 pandemic in the U.S., 60% of employers have reduced job openings, with almost 25% of employers closing all of their postings, according to job searching platform Glassdoor.

When looking at its data, Glassdoor found that job openings on its site had decreased by 20.5% between March 9 and April 6, bringing its number of employment opportunities to 4.8 million. That number, according to Glassdoor, marks the lowest number of openings on its platform since February 2017.

"For perspective, the U.S. is on track to lose as many job openings on a percentage basis in the first four weeks of the crisis as we did in the first nine months of the Great Recession," Glassdoor economist Daniel Zhao wrote in a blog post. —Courtney Connley

10:32 am: Bill Gates calls Trump's decision to halt funding for WHO 'as dangerous as it sounds'

Bill Gates said the White House should not withhold funding for the World Health Organization during a global pandemic, a day after the president announced his intent to do so.

President Donald Trump announced that the U.S. is suspending funding from WHO while it reviews the agency's response to the coronavirus pandemic.

"Halting funding for the World Health Organization during a world health crisis is as dangerous as it sounds," Gates said on Twitter early Wednesday morning. —Jessica Bursztynsky, Christina Wilkie

10:21 am: Homebuilder confidence index takes the biggest one-month dive in its history

A crucial indicator of homebuilder sentiment suffered its biggest monthly drop in the index's 35-year history this month, as the coronavirus pandemic hammered the American economy.

Builder confidence in the market for single-family homes plunged 42 points to a reading of 30 in April, the lowest point since June 2012, according to the latest National Association of Homebuilders/Wells Fargo Housing Market Index, or HMI. The survey dates back to January 1985.

The reading was expected to drop to 55. Anything above 50 is considered positive. The last negative reading was in June 2014. —Diana Olick

10:17 am: Abbott's new antibody test could handle up to 20 million screenings in June

Abbott Laboratories launched its third test for the coronavirus and said it could be screening up to 20 million people for antibodies for Covid-19 by June. Abbott said it plans to distribute 4 million of the new antibody tests by the end of this month, after an initial shipment of 1 million tests this week to US customers, beginning Thursday.

"Antibody testing is an important next step to tell if someone has been previously infected," Abbott said in a press release. "It will provide more understanding of the virus, including how long antibodies stay in the body and if they provide immunity," the company said.

Abbott's two other coronavirus tests, which only recently were introduced, determine whether a person has Covid-19 now. One of those tests can tell in 13 minutes or less if a person at a testing site is currently infected, while the other test is performed in labs.

The new antibody test announced Wednesday will reveal if a person also had been infected in the past, even if they were no longer sick. —Dan Mangan, Meg Tirrell

9:48 am: China didn't warn public of likely pandemic for 6 key days

President Xi Jinping warned the public they likely were facing a pandemic from a new coronavirus on Jan. 20. But by that time, more than 3,000 people had been infected during almost a week of public silence, according to internal documents obtained by The Associated Press and expert estimates based on retrospective infection data.

That delay from Jan. 14 to Jan. 20 was neither the first mistake made by Chinese officials at all levels in confronting the outbreak, nor the longest lag, as governments around the world have dragged their feet for weeks and even months in addressing the virus.

"This is tremendous," said Zuo-Feng Zhang, an epidemiologist at the University of California, Los Angeles. "If they took action six days earlier, there would have been much fewer patients and medical facilities would have been sufficient. We might have avoided the collapse of Wuhan's medical system."

Other experts noted that the Chinese government may have waited on warning the public to stave off hysteria, and that it did act quickly in private during that time. —Associated Press

9:34 am: Dow tumbles more than 500 points as coronavirus shutdown slams economy, bank earnings

Stocks fell sharply Wednesday as dismal economic data and weak bank earnings fueled concerns over the coronavirus's impact on the U.S. economy.

The Dow Jones Industrial Average dropped 530 points at the open, or 2.2%. The S&P 500 slid 2.3% while the Nasdaq Composite traded 1.9% lower. —Fred Imbert, Maggie Fitzgerald

9:30 am: New York, New Jersey continue to have highest number of confirmed cases

9:24 am: Best Buy to furlough about 51,000 employees as its stores remain closed

Best Buy will furlough about 51,000 employees starting Sunday. The retailer's stores have been closed across the country since March 22, but it has continued to pay its employees and offer curbside pickup. It also suspended all in-home delivery, installation and repairs.

Starting Sunday, Best Buy said it will furlough nearly all of its part-time store employees and some of its full-time store employees in the U.S. About 82% of its full-time store employees will continue to be paid. —Melissa Repko

9:15 am: US clinical trials of hydroxychloroquine could show in weeks whether it works

Researchers are working as quickly as science will allow to determine whether hydroxychloroquine, a decades-old malaria drug touted by President Donald Trump as a potential "game changer" in curtailing the Covid-19 pandemic, is effective in fighting the coronavirus. One study at NYU Langone and the University of Washington s a randomized controlled trial designed to determine whether hydroxychloroquine is any better than a placebo in preventing Covid-19. The New York State Department of Health, in partnership with the University of Albany, is also conducting a so-called observational study that researchers hope can shed some insight into the drug's potential effectiveness in a matter of weeks, possibly before May. —Berkeley Lovelace, Jr.

9:13 am: New York manufacturing hits record low reading of -78.2 amid coronavirus collapse

The Empire State Manufacturing Index for April hit minus 78.2, worse even than the -32.5 expected by economists surveyed by Dow Jones. The worst reading the index had seen was -34.3 during the financial crisis.

The index measures companies reporting better versus worse conditions over the past month. Just 7% reported stronger conditions, while 85% said things had weakened.

As businesses shut down due to coronavirus restrictions, it was no surprise that firms in New York, which has been the U.S. epicenter of cases, would experience a downturn or near total stoppage. However, the outlook ahead wasn't much better, with the future expectations index registering a 7% reading. —Jeff Cox

9:05 am: South Africa extends lockdown but offers a road map for reopening

South Africa has extended its nationwide lockdown for two weeks but outlined criteria for lifting restrictions, with coronavirus cases in the country so far avoiding the sharp trajectory seen in Europe and the U.S.

South Africa remains the most affected country in Africa by the pandemic, with 2,415 confirmed cases as of Wednesday morning, according to Johns Hopkins University. However, the spread of Covid-19 has been far less severe than expected. —Elliot Smith

8:59 am: US retail sales in March saw the biggest decline since 1992

U.S. retail sales suffered a record drop in March as mandatory business closures to control the spread of the coronavirus outbreak depressed demand for a range of goods, setting up consumer spending for its worst decline in decades.

The Commerce Department said retail sales plunged 8.7% in March, the biggest decline since the government started tracking the series in 1992, after falling by a revised 0.4% in February.

According to a Reuters survey of economists, retail sales were forecast to have fallen 8% last month. —Reuters

8:54 am: Harvard researchers warn social-distancing measures may need to remain in place into 2022

Researchers from the Harvard T.H. Chan School of Public Health have warned that in the absence of a vaccine or an effective treatment of the coronavirus, social-distancing measures may be required through to 2022.

In a study published Tuesday in the journal Science, epidemiologists at Harvard assessed what is known about Covid-19 and other coronaviruses to anticipate possible scenarios for the current global health crisis.

It said social-distancing measures, such as school closures, bans on public gatherings and stay-at-home orders, may have to remain in place for at least the next couple of years.

"Absent other interventions, a key metric for the success of social distancing is whether critical care capacities are exceeded," they said. "To avoid this, prolonged or intermittent social distancing may be necessary into 2022." —Sam Meredith

8:45 am: Americans are spending their coronavirus stimulus checks on food, gas, and paying back friends

Data compiled by digital bank Current found members who received stimulus payments over the past five days spent 16% of the money on food, including takeout and delivery. An additional 9% of spending was on groceries and 10% went toward gas.

"Clearly food is an issue, people are struggling," Current CEO Stuart Sopp told CNBC. "They're just trying to survive, and I think that's what the stimulus was all about."

The figures give an early glimpse at how Americans will use cash transfers from the government as the coronavirus pandemic has shut down businesses and left millions unemployed.

The CARES Act, which was passed by Congress at the end of March, provided one-time cash transfers of up to $1,200 to individuals to assist with the economic fallout of the pandemic. The Treasury Department said this week that tens of millions of Americans will receive payments via direct deposit by Wednesday. —Elizabeth Schulze

8:05 am: Trump's decision to withdraw WHO funding prompts international criticism

President Donald Trump's announcement that he is going to withdraw U.S. funding for the World Health Organization has provoked criticism from around the world.

Among those voicing opposition was philanthropist Bill Gates, who called the decision "as dangerous as it sounds." Germany's Foreign Minister Heiko Maas tweeted that "blaming does not help," adding, "the virus knows no borders." He said the WHO was already underfunded. The European Union's foreign policy chief, Josep Borrell, said he "deeply regretted" the decision.

United Nations Secretary-General Antonio Guterres said earlier that now is "not the time" to cut WHO funding, as the world grapples with the coronavirus pandemic.The WHO is the United Nations' health agency.

Trump said Tuesday the U.S. will suspend funding to the WHO while it reviews the agency's response to the Covid-19 pandemic. He has accused the agency of making mistakes in its approach to the virus. However, some have criticized the White House for what they see as an inadequate response to the crisis. —Holly Ellyatt

7:29 am: CDC director says the agency has a productive relationship with WHO

The director of the U.S. Centers for Disease Control and Prevention said the agency has a very productive relationship with the World Health Organization, whose funding was cut by President Donald Trump over the coronavirus crisis.

"The CDC and WHO have had a long history of working together in multiple outbreaks around the world as we continue to do in this one," CDC chief Robert Redfield said in an interview with ABC's "Good Morning America." "We've had a very productive public health relationship. We continue to have that." —Reuters

7:14 am: WHO recommends governments restrict alcohol access

The World Health Organization's regional office for Europe recommended governments restrict access to alcohol and "any relaxation of regulations or their enforcement should be avoided." More than 3 million people die every year from alcohol, the WHO said, adding that alcohol consumption during an emergency can "exacerbate health vulnerability, risk-taking behaviors, mental health issues, and violence."

Alcohol sales in the U.S. were up 22% at the end of March, compared with a year earlier, according to Nielsen.

"During the COVID-19 pandemic, we should really ask ourselves what risks we are taking in leaving people under lockdown in their homes with a substance that is harmful both in terms of their health and the effects of their behavior on others, including violence," said Carina Ferreira-Borges, program manager for WHO Europe's alcohol and illicit drugs program. —Will Feuer

6:15 am: Russia rejects criticism of its handling of the crisis

The Kremlin rejected criticism of its handling of the coronavirus crisis after China said its largest source of new, imported cases, had come from the far northeastern part of the country that borders Russia.

"We hear that there is now an exchange of criticism over coronavirus between different countries, which is played like pingpong. We consider this to be a thankless exercise," Kremlin spokesman Dmitry Peskov said, Reuters reported. —Holly Ellyatt

5:40 am: Race for vaccine 'is a global effort' for mankind — not just one country, Germany says

As the coronavirus spreads around the world, experts are scrambling to develop a vaccine to protect millions of people from infection.

Finding a vaccine is a collaborative effort, experts say, and is expected to take around 12-18 months. The World Health Organization said over the weekend that there are currently 70 vaccine candidates in development.

But who, or which country, gets priority when a vaccine is finally found is yet to be seen and could prove controversial.

The president of Germany's Federal Institute of Vaccines and Biomedicines, an agency of the German Ministry of Health, told CNBC that the race to develop a vaccine is a collaborative and cooperative effort. —Holly Ellyatt

5:05 am: Spain's daily death toll from the virus falls

Spain's death toll rose to 18,579, up from 18,056 the day before, Spain's health ministry said. That's a daily increase of 523 deaths, down from 567 deaths reported the previous day. On Monday, 517 new deaths had been reported.

The total number of confirmed cases in Spain has now reached 177, 633.—Holly Ellyatt

4:20 am: Crisis will erase nearly a decade of oil demand growth this year, IEA says

The International Energy Agency said it expects the coronavirus crisis to erase almost a decade of oil demand growth in 2020, with countries around the world effectively having to shut down in response to the pandemic.

A public health crisis has prompted governments to impose draconian measures on the lives of billions of people. It has created an unprecedented demand shock in energy markets, with mobility brought close to a standstill. —Sam Meredith

4:11 am: Germany to extend restrictions to May 3, media reports

Germany will extend restrictions on movement introduced last month to slow the spread of the coronavirus until at least May 3, Handelsblatt business daily reported, citing the country's DPA news agency.

Chancellor Angela Merkel is holding a video conference on Wednesday with Cabinet ministers, and later with the leaders of Germany's 16 states, Reuters reported. Officials are set to discuss whether to ease lockdown measures given Germany's improving coronavirus data. —Holly Ellyatt

Read CNBC's coverage from CNBC's Asia-Pacific and Europe teams overnight here: Criticism mounts on Trump after US withdraws funding for WHO